HI, WHAT DO YOU WANT TO YOUR

Dream Plot

HI, WHAT DO YOU WANT TO YOUR

Dream Plot

Where you are as rooted in earthy tradition as you are connected to modern conveniences.

An economically balanced, eco-friendly, sustainable and smart city.

Anantam is a development that aims to provide top-quality living conditions with modern infrastructure while blending in with the cultural heritage of Braj Sanskriti. Its approach is all-encompassing as the project caters to spiritual centers, public spaces, and different types of housing units to make it a complete city in its own right. The design and development philosophy showcases modern forms of architecture that mesh seamlessly with the cultural landscape of the region. Anantam is more than a housing project but rather an integrated township that promotes an urban lifestyle with access to all the amenities of modern living while preserving the cultural heritage of the region.

Six major types of plotted residential units with plot areas ranging from 117 sq yards to 520 sq yards so as to accommodate the needs

of different sections of the housing prototype. Independent Plots and Group Housing Plots

Townhouses Villas

Single Family Semi-detached House

Independent Floor

Mid-rise Apartments

High-rise Apartments

OVERVIEW

RESIDENTIAL

Plots for Townhouses Villas, Single family house, Independent floor, Mid-rise apartments High-rise apartments,

RESIDENTIAL

Plots for early childhood to high-schools

COMMERCIAL & INDUSTRIAL

Plots for office building Plots for non-polluting industries

COMMERCIAL & INDUSTRIAL

Plots for Health Facilities

RESIDENTIAL PLOTS SIZE

22'96" X 45'93"

117 sq.yd. (098 sq.m.)

29'52" X 62'33"

205 sq.yd. (171 sq.m.)

32'80" X 65'61"

239 sq.yd. (200 sq.m.)

32'80" X 82'00"

299 sq.yd. (250 sq.m.)

32'80" X 82'00"

299 sq.yd. (250 sq.m.)

39'37" X 82'00"

359 sq.yd. (300 sq.m.)

45'93" X 102'03"

520 sq.yd. (435 sq.m.)

FOR PRICE/PAYMENT PLAN CALL

LOAN FACILITIES

LOCATION

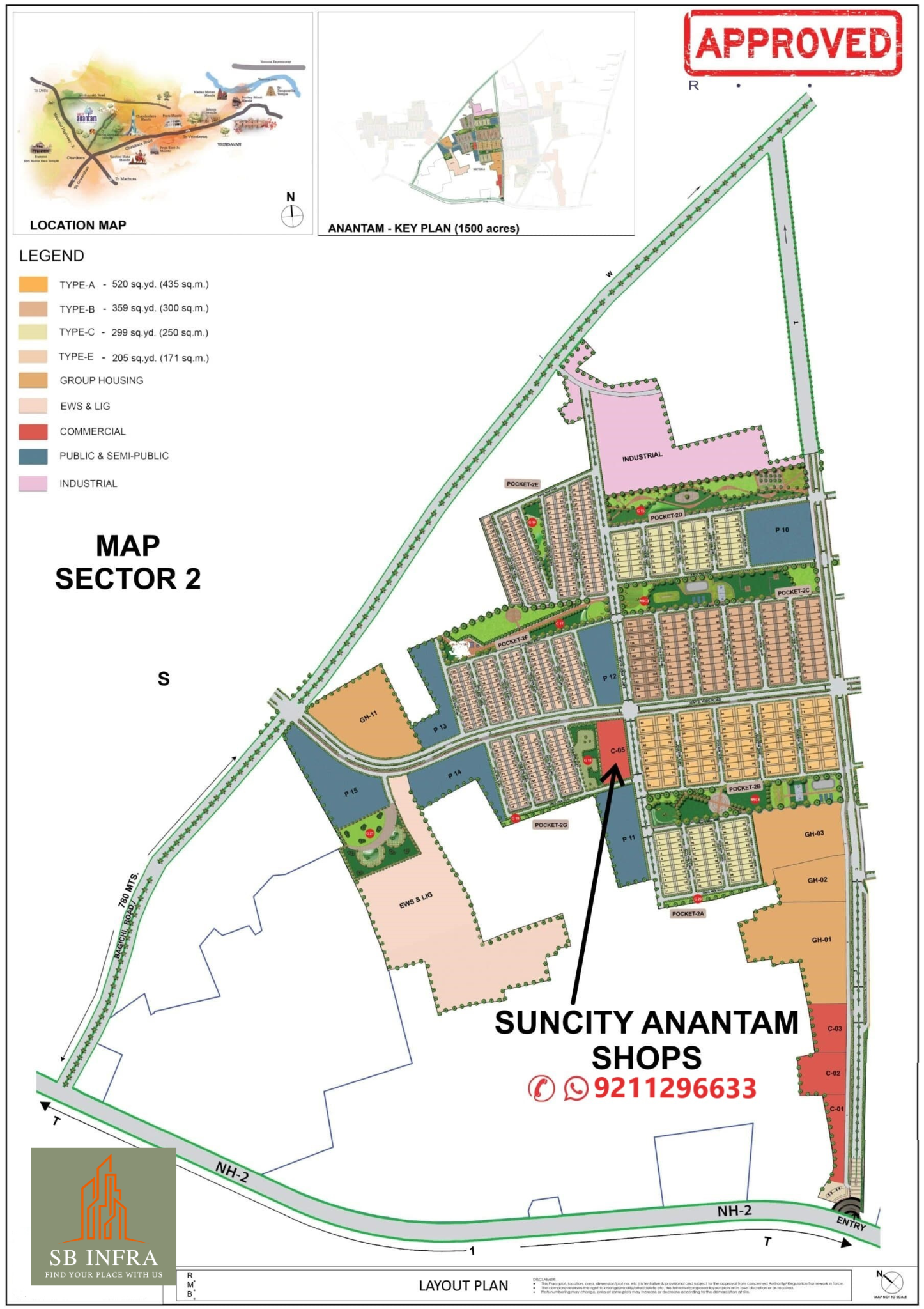

The Project site is located at NH-2

Connecting Delhi, Mathura and Agra:

- 155 KM From New Delhi

- 125 KM from Greater Noida

- 120 KM from Gurgaon

- 12 KM from Yamuna Expressway

- 55 KM from Agra

- 8 KM from Mathura

- 6 KM from New Bus station, Mathura

- 14.6 KM from Railway station, Mathura

Distance from Suncity Anantam:

- Chandrodaya Mandir- 1 km

- Prem Mandir- 8 km

- ISKCON Temple – 10 km

- Garud Govind Temple – 0 km

- Madan Mohan Mandir- 5 km

- Shri Rangnath Mandir-14 km

Maa Vaishno Devi Dham – 3 km - Bankey Bihari Mandir-5 km

- Barsana Shri Radha Rani Temple – 35 km

- Goverdhan – 18 km

- Nandgaon – 40 km

- Gokul – 23 km

- Baldeo – 35 km

FREQUENTLY ASKED QUESTIONS

There are different types of home loans available depending upon the purpose for which the home loan is being taken.

In order to avoid any unpleasant surprises in future, the buyer should at the first place be aware of his financial credibility, eligibility and affordability. He should compare the interest rates offered depending on the type of loan, and should be aware of other things like refinancing option, flexible payments option, foreclosure charges if any and part payment facility.

To avoid any unpleasant surprises in the future, the buyer should be aware of their financial credibility, eligibility, and affordability from the outset. They should compare interest rates offered for different types of loans, and be aware of additional factors such as refinancing options, flexible payment options, any foreclosure charges, and the possibility of part payments.

In order to take out a home loan, the applicant must be either an NRI or a resident of India, 24 years of age or older at the time of loan commencement, and under the age of 60 at the time of loan maturity. The applicant must also have a steady source of income.

The correct spelling and grammar of the message is:

“The additional costs that usually come with a home loan are processing charges, pre-payment charges, and miscellaneous costs such as documentation or consultation fees.”

Both the principal and interest of home loans have tax benefits, as specified under section 80C of the Income Tax Act 1961. The principal amount of repayment of the loan, along with other savings such as PF, PPF, and Life Insurance premium, etc., up to a maximum of Rs 1,00,000/- will be eligible for deduction from gross income. Additionally, the interest paid up to a maximum of Rs 1,50,000/- will be eligible for deduction from gross income on the loan after the completion of construction. It will also be deductible from income from property.